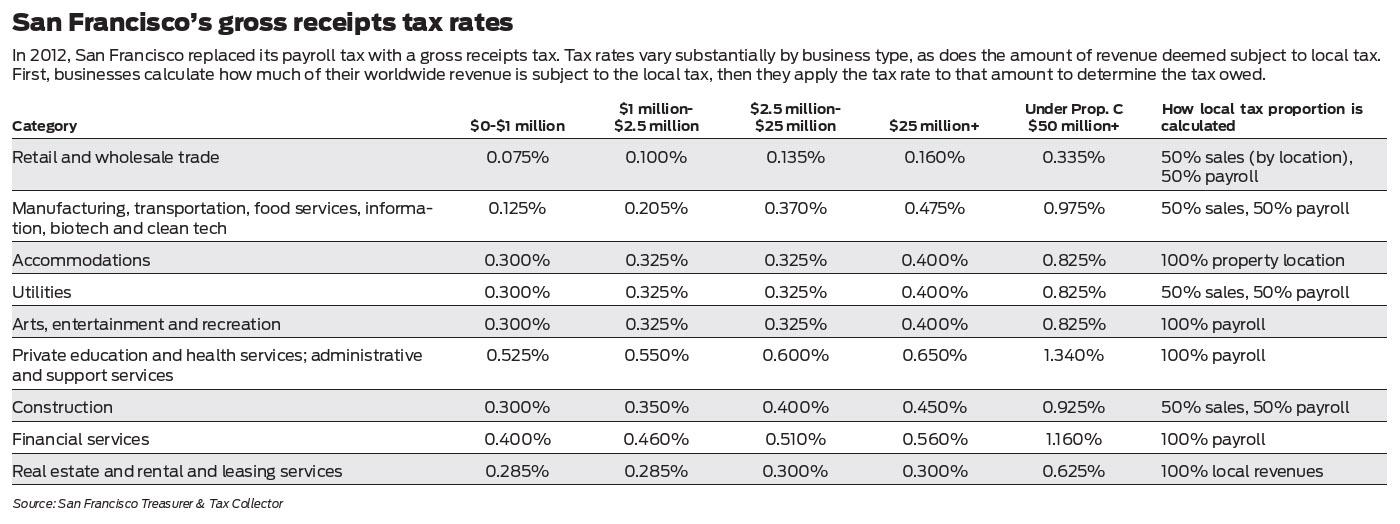

san francisco gross receipts tax apportionment

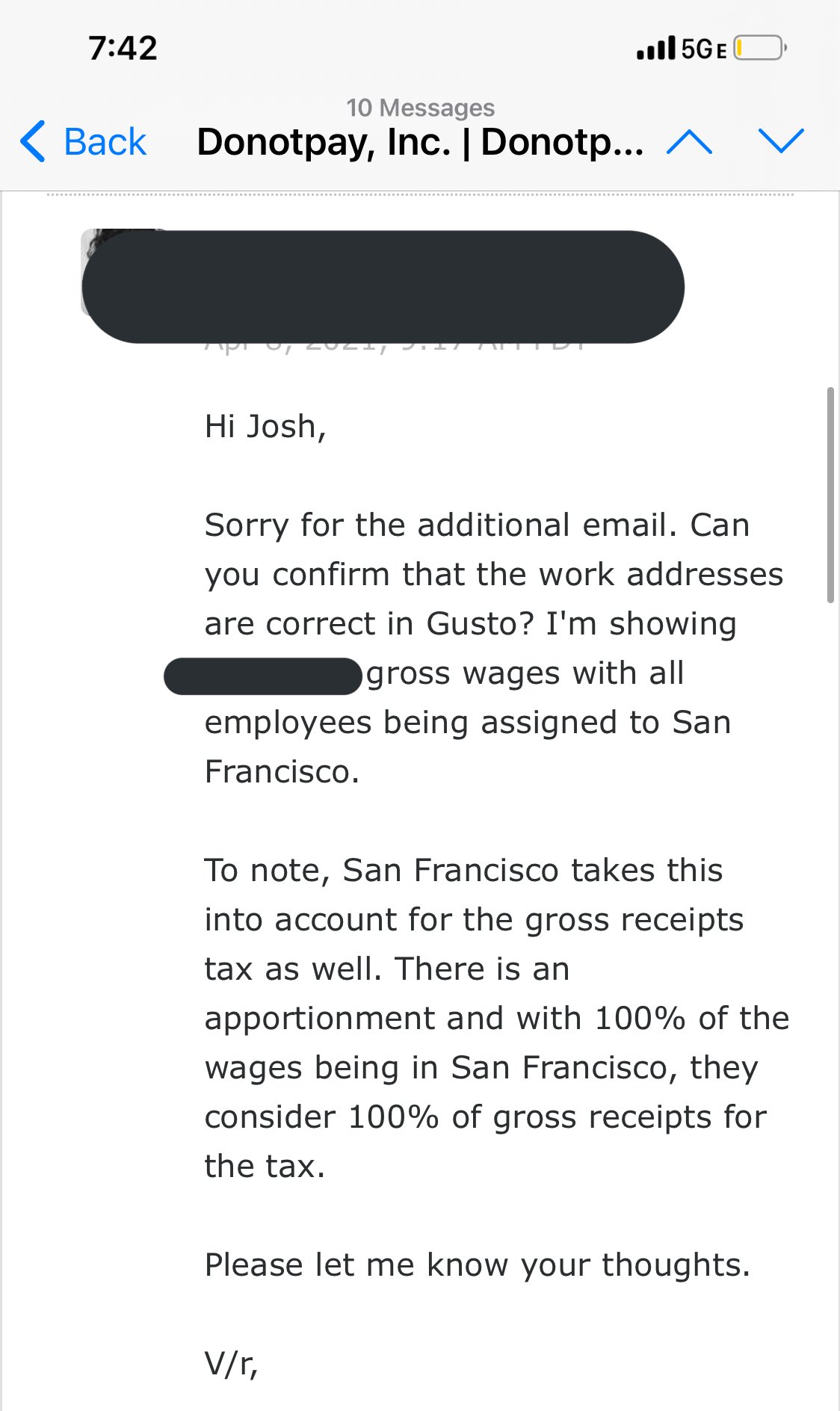

Administrative Office Tax For any business maintaining an administrative office in the city the tax is graded based on companies CEO pay ratio 04 of companies total taxable payroll. All persons deriving gross receipts from business activities both within and outside the City shall allocate andor apportion their gross receipts to the City using the rules set forth in Section.

Uc Davis Summer Tax Institute Advanced Income Tax Track Ppt Download

The City began making the transition to a Gross Receipts Tax from a Payroll.

. 1 The measure will. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Payroll Expense Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. D For tax year 2024 if the Controller certifies under Section 95310 that the 95 gross receipts threshold has been met for tax year 2024 and for tax years beginning on or after January 1.

Businesses operating in San Francisco pay business taxes primarily based on gross receipts. 1 This gross receipts tax will gradually. On November 6 San Francisco voters approved Measure E which imposes a gross receipts tax on persons engaged in business activities in San Francisco.

The voters of San Francisco the City recently approved Proposition E a gross receipts tax that will be phased in over five years beginning in 2014.

San Francisco Taxes Filings Due February 28 2022 Pwc

Income Franchise Gross Receipts Tax Bdo Tax

San Francisco Adopts Major Changes To Business Taxes 2019 Articles Resources Cla Cliftonlarsonallen

Gross Receipts Tax And Business Registration Fees Ordinance Ppt Download

Ghj California Understanding The Tax Burden

Prop C Would Raise Sf S Gross Receipts Tax Here S What That Means

San Francisco Begins Transition To Gross Receipts Tax The Bar Association Of San Francisco

State By State Guide Which States Have Gross Receipts Tax Taxvalet Sales Tax Done For You

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

Bad Tax Laws Badtaxlaws Twitter

Annual Business Tax Returns 2019 Treasurer Tax Collector

Annual Business Tax Returns 2021 Treasurer Tax Collector

What S Happening Tuesday December 16 Doug Lindholm William Mcarthur Council On State Taxation Tyco Electronics Fred Marcus Principal Horwood Ppt Download

San Francisco S Sourcing Rules For Computing The Gross Receipts Tax

Joshua Browder On Twitter Just Heard Back From The San Francisco Tax Office According To Them They Consider 100 Of Your Revenue To Be In San Francisco For The New Gross Receipts

Cost Of Performance Vs Market Based Tax Apportionment Explained Fusion Cpa I Tax Accounting Netsuite Consulting Services